COVID-19 Impact on the Diamond Trade

2020.08.22

Few or the world’s most stable markets were able to avoid the touch of the novel coronavirus, and the diamond industry was no exception.

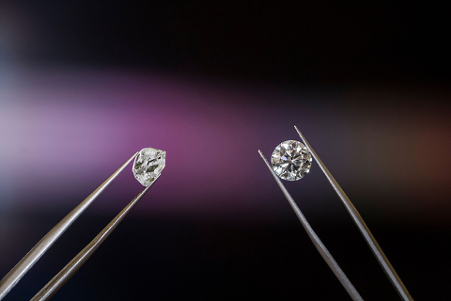

The DOW, oil, and even gold felt a bit ill following covid-19’s economically destructive entrance. In March of this year, a number of industries were left in ruins following mandatory lockdown and stay at home orders. March saw fern differences for the diamond trade, particularly in the cut and polished markets. In that month the Rapaport Group, the diamond industries’ biggest polished diamond trading platform, announced that prices would be unilaterally adjusted- in the downward trajectory. The uproar within the industry was something never before seen. Even during the world's most dire economic times.

The mass exodus of former gem traders, polishers, and suppliers was felt globally. Which left distributors crying out for better options when it comes to polished trade. Which has led to unprecedented innovation, bringing in much needed change to the antiquated habits of the industry itself. Companies like UNI Diamonds are now starting to see a surge in adoption and respect, as digital platforms and peer-to-peer facilitators may be the way forward, finally bringing the trade industry into the 21st century.

Movement of the Masses

In an open letter was written to industry leaders decrying the Rapaport Groups (RG) price decline. The writers, comprised of traders and manufacturers from the major diamond hubs grouped together to compose a letter begging for better industry standards and supply. Calling the developments “unprecedented”, saying they were “shocked and extremely disappointed” with RG’s unilateral price decline.

The writers go on to say that because the hit the industry took throughout the supply and distribution pipelines, a unilateral price decline of one of the biggest, and only, polished diamond trading platforms would all but destroy the entire industry. Saying that the change was not a reflection of “actual trading prices and the volumes of polished diamonds bought and sold”, leaving smaller retailers and buyers holding the bill of larger distributors. Owing this largely to the greed of RG, stating that “RG’s actions are further proof that , over the years, it has operated and dictated polished diamond prices in a non-transparent manner… let alone a mechanism or rationale that lies behind its decision making process.”

The letter went on to describe how some of the biggest influencers and traders “have come together to voice their resistance and rejection of RG’s actions.” Asking for a “new, independent, non-biased and transparent reference…” in the industry. Which for many, has been a long time coming. Since the release of the letter in April 2020, more than 500 diamond traders and manufacturers have removed their inventory from RG’s trading platform. To a tune of close to $6 billion dollars worth of lost stock.

Where Does it Go From Here

Following this unexpected and never before seen removal, the diamond trade has started to embrace technology and newer trading patterns, bringing them firmly back in line with modern day business. A move that some believe has needed to happen for sometime. Despite the continued hardships the industry sees, particularly at the upstream outlets, prices are beginning to normalize as business embraces better practices.

By using peer-to-peer networking, and digital trade platforms, the industry has been able to balance production and demand, something it hasn’t been doing well for decades. As mining operations closed due to covid-19 restrictions and health practices, rough buying declined. The polished buying industry has also seen a dip in requirements, particularly following the RG incident. Slowing both manufacture and trade.

But major suppliers like De Beers and Alrosa have pivoted perfectly alongside new industry habits, allowing clients to refuse contracted supply. Easing midstream liquidity and preventing build ups in polished inventory. Helping to create an equilibrium within the market that more closely reflects current demand. Serving to firm up both prices, and the need for better trading platforms. So while the pandemic has, without a doubt, caused many disruptions and horrific consequences for many aspects of modern life- for the diamond industry, it has propelled old-world practices to shift and begin to better reflect a modern market.

More Articles

Copyright © Fooyoh.com All rights reserved.