What Every Broker Should Know About Crypto CFD Trading

2022.12.03

The likelihood of profiting from trades improved significantly thanks to the development of cryptocurrencies and the way we can trade them. CFDs' cryptocurrency trading is one such approach. The original stock market tradition of day trading has recently found its place in modern cryptocurrency exchanges. The only difference is that cryptocurrency is used instead of fiat money when trading crypto CFDs.

In this article, we will cover all the essential information concerning crypto CFDs, their benefits, what steps to take, and what to consider before providing crypto CFD trading services.

What Is Crypto CFD Trading?

Thanks to crypto CFDs, also known as contracts for differences, you can speculate on the future movements of particular cryptocurrencies without using a lot of funds. Sure, there is a risk involved with CFD trading, just like conventional stock market trading.

This method of investing enables investors to profit from market swings, much like traditional CFDs. With a reasonably small upfront commitment, CFDs allow you to forecast or speculate on the price trend of a particular crypto asset, like Bitcoin or any other altcoin.

That said, CFDs are contracts that pay the difference between opening and closing prices. The trader should very carefully determine when the price will start changing. Traders themselves are responsible for covering any losses incurred by the specific trade.

But how does CFD crypto trading work in practice?

Crypto CFDs function similarly to traditional markets. Here, the broker or the investor will be required to pay the difference between the asset's open and close prices according to a contract that involves these two parties.

Because CFDs are derivative products, traders do not acquire control of the fundamental asset; instead, they only profit or lose money depending on changes in the asset's value. By taking long positions, which are predictions that the value will move up, and short positions, which are predictions that the price will decrease, investors can profit from either bullish or bearish movements in CFD cryptocurrency trading.

Due to high cryptocurrency liquidity and volatility, cryptocurrencies have become a highly popular alternative for CFDs because they frequently undergo significant price movements that give traders numerous opportunities to make substantial profits, mainly when using leverage. For instance, the cryptocurrency Ethereum (ETH) has become a desirable CFD trading asset due to its volatility. The cost increased from around 700 USD to reach its all-time high of over 4,100 USD during just six months of 2021.

Now, let's take a look at the main advantages of CFD trading and why they are becoming increasingly popular each year.

What Are The Advantages Of Crypto CFD Trading?

Regulation

Firstly, an official regulatory watchdog like CySec, the FCA, and others constantly monitor every single CFD broker. It means that a trading firm's users are more secure against manipulation, fraud, and cyber theft. Besides that, investors can file a complaint for reimbursement and receive all or some portion of their money back in the case of bankruptcy and other unfavorable conditions.

Simple configuration

Secondly, technical difficulties often complicate trading. Wallet activation, lengthy verification phase, and other crypto-related complications might frighten the “not tech-savvy” customers. Consequently, they usually prefer exchanges with a solid track record of customer service, simple account setups, and “one-click” trading techniques. Additionally, those who already trade CFDs for other trading products are more likely to employ this instrument to add cryptocurrencies to their current CFD portfolio, profit from price fluctuations, and enjoy other CFD liquidity benefits.

Speed of trading

As already mentioned, similar to classic CFDs, you don't buy or sell assets; instead, all of your operations are quickly conducted out on the trading platform of the broker. The benefit here is that you have the flexibility and can respond rapidly to changes in the market. Note that market participants would not be able to profit from quick movements in the free market because crypto transactions on the blockchain might take several minutes to complete. That, of course, depends on the coin and the network's capacity.

Now, let's look at the several factors to consider before providing CFD liquidity and trading services.

What Steps To Take And What To Consider Before Offering Crypto CFD Services?

It would be a terrific idea to establish an exchange and provide CFD trading services, given the surge in the adoption of cryptocurrency CFDs. However, be aware that popular cryptocurrencies are not recognized as securities, currencies, properties, or commodities in many jurisdictions and are not subject to regulation. That said, always ensure that you are perfectly informed about the latest updates of regulatory policies, depending on the country you are based in. Considering help from professionals who would assist you in following the necessary procedures is also recommended.

Now, what are the main factors to consider before setting up a crypto CFD brokerage?

Regulations

Regulations are the core of every centralized business and service. In every jurisdiction, crypto CFDs are treated differently. Nonetheless, every single one of them is constantly monitored. Say you want to open a CFD brokerage in the European Union. Since this is a regulated enterprise, you must obtain a local regulator's approval before producing, distributing, or trading in CFDs.

It is essential to have a registration and authorization to "deal in investments as principal" to create a regulated Crypto CFD brokerage. However, providing and presenting high-risk investing tools is controlled and deals with requirements for economic substance, marketing, advertising restrictions, trade execution criteria, internal business process requirements, leverage limitations, capital requirements, etc.

It is worth mentioning that going overseas is another popular choice for people who want to start up a crypto CFD exchange and offer their trading services. Typical offshore financial centers are generally less restrictive in terms of accreditation, enduring procedures, monitoring, and have fewer operational and market constraints. Also, most firms find offshore territories appealing due to their tax-neutrality.

Consider leverage factors

As already mentioned, different jurisdictions allow various leverage limitations and CFD asset types.

For example, in the EU, the promotion, distribution, and sale of CFDs by EEA-regulated businesses to retail investors are subject to various regulations that were issued by the European Securities and Markets Authority (ESMA). It all depends on the underlying asset's volatility, but on average, retail customers' leverage restrictions for starting a position range from 2:1 to 30:1. Some may offer even 50:1 or more, but it is much riskier for everyone involved.

Money laundering controls (KYC/AML)

Every CFD brokerage is responsible for completing KYC/AML requirements in the country where they were established. The watchdog will evaluate if the company has implemented appropriate methods, such as compliance requirements and policies that help control and reduce risks related to money laundering and terrorism financing.

Firms that are subject to regulation must also carry out extensive client research procedures. In other words, every customer who wants to open an account must provide information, which must be checked and verified by the firm.

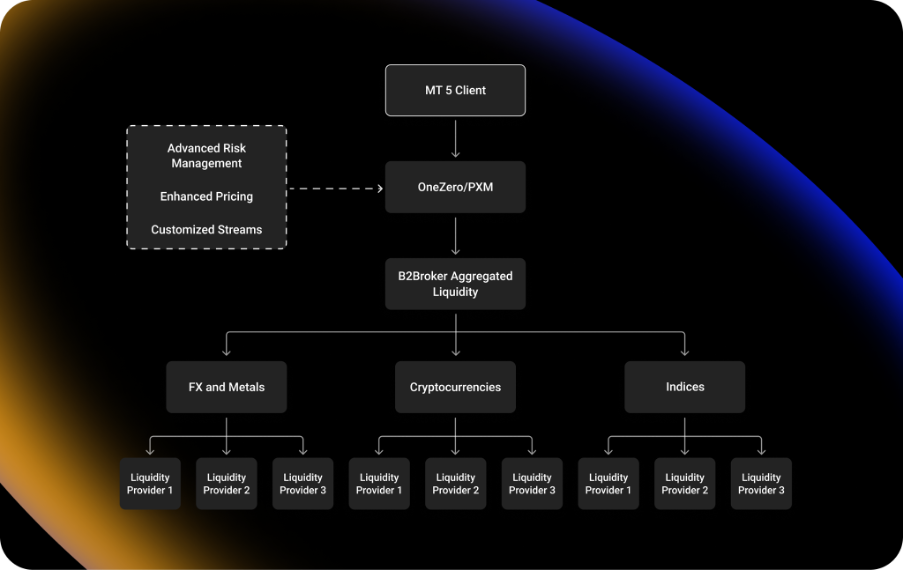

Finding a crypto CFD liquidity provider

Last but not least, you should find a serious CFD liquidity provider that matches your goals. There are few factors that you should consider before making a decision.

A) The amount of available instruments — The majority of CFD liquidity providers only offer liquidity for 10–20 trading pairs, which is insufficient for experienced traders. Entrepreneurs and retail traders will most likely look for industry leaders, which provide over more than 100 crypto pairings. Finding a solid provider is crucial since future success also depends on who you work with.

B) Margin conditions — According to most traders, the main benefit of crypto CFDs is leverage; for this reason, margin restrictions are vital. Top-rated liquidity providers offer leverage of up to 1:5 on average, whereas some expand customer prospects by providing leverage of up to 1:10 or even 1:30 for selected pairings.

C) Spreads — Brokerage firms must evaluate spreads since it is one of the most important factors that traders are looking for, and everyone will prefer the smallest spreads possible.

Regarding top-level quality CFD liquidity providers, it is worth sharing that B2Broker has added additional cryptocurrency CFD pairs, making a total of 150, which will be available on the platform. Crypto assets such as FTT, MANA, AAVE, COMP, SNX, APE, QTUM, THETA, KSM, and YFI are new additions and each of them is connected with USD. With this new achievement, B2Broker keeps setting the standard for offering a broad range of services and tools for our institutional clients.

These new crypto CFD tools offer the same quality of crypto CFD liquidity together with narrow spreads that our customers can obtain at any time while working with us. They are ideal for trading because they also have deep order books and will give their clients more options to trade the markets.

At B2Broker, we believe that our clients will benefit from this improved service. We are dedicated to working hard, delivering the best service possible in the market, and going above and beyond for each of our clients.

Bottom Line

CFD cryptocurrency trading is a type of activity that enables you to make financial predictions about the success or failure of a particular cryptocurrency. Due to the dangers they represent, the instruments are heavily regulated. If you're interested in offering high-quality CFD crypto trading as a brokerage firm, make sure you do your own research, consider all steps prior to launching the firm, and ensure that you use the best crypto CFD liquidity providers, such as B2Broker.

More Articles

Copyright © Fooyoh.com All rights reserved.