Tips For You To Get Complete Advantage Of Uber Insurance

2016.10.18

Uber is one of the most popular and highly reputed cab services. This is getting better and better which means that the drivers have bigger responsibility as well. There are so many people who think that purchasing Uber Insurance is all they will need to do in order to avail the advantage of insurance but this is not the fact.

The best thing that can allow you to get complete advantage of your insurance plan is proper knowledge of all the insurance features and factors so that you can understand the actual nature of the insurance policy that you have taken for Uber cab.

In order to understand the insurance for Uber efficiently, you will need to do some research and if you don’t want to spend your days in research then you can read simple tips that can help you to get complete advantages of insurance. To save your time, here I am sharing with you some of the most common but highly effective tips that will certainly help you to get proper awareness and complete advantage of insurance without actually spending too much time in research for this matter.

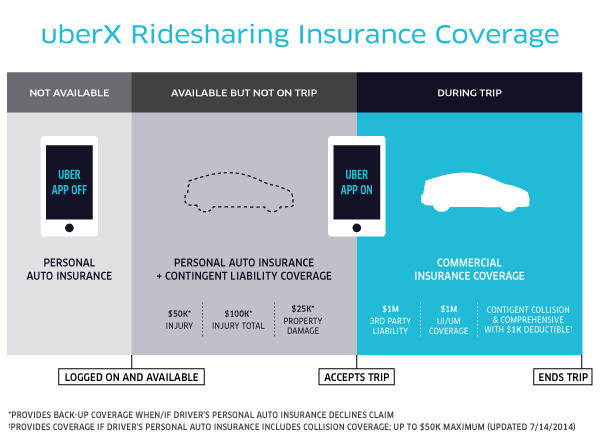

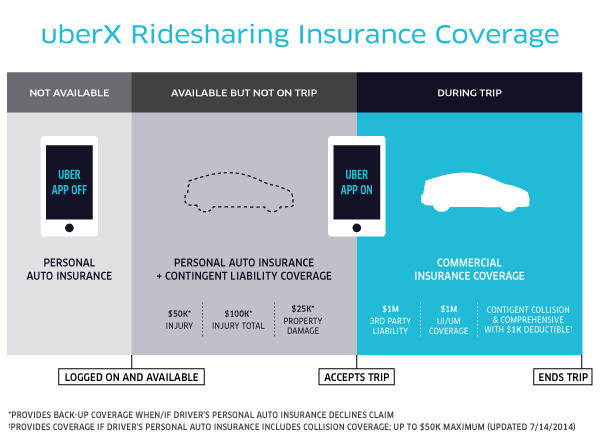

Transportation Network Company (TNC) Terms: The coverage of insurance liability is necessary for every Uber drive and it will give the driver proper advantage of incidental or accidental death and personal injury. The Uber coverage also includes the passenger coverage but this is just timely because it is applicable on passengers from the time when they aboard the can and till the time they leave the vehicle.

Proof Of Insurance Coverage: If you want to make sure that you get the coverage advantage of Ridesharing Car Insurance then it is necessary that you carry the insurance coverage proof with you all the time so that the insurance company can provide you coverage instantly in any situation of requirement.

Understanding Of Rules: The rules of Uber Insurance are different for business and personal purposes. If you are running a business then the corporate insurance should be selected and if you are using Uber for personal purposes then you need to take the personal insurance for Uber. They will carry different quotes and the advantages will be different as per the basic insurance requirements.

There are so many people who ignore these simple things and then they face unnecessarily dissatisfactory consequences of issuance plan even when they have all the insurance features that they will need to satisfy their needs. Therefore, make sure that you don’t forget to follow the standard rules and regulations of Uber insurance. If you are confused about the terms then you can simply read the terms and conditions of insurance coverage of the insurance plan that you have taken for your vehicle.

This is the best thing to do to ensure that you are aware of all the necessary aspects regarding your vehicle insurance and this will definitely allow you to get best advantages of insurance whenever you need it. So, what are you waiting for? If you are ready to take the insurance or if you think that you are missing some advantages that you should be getting from the insurance plan that you have then you need to do proper reading of insurance features and conditions to get rightful features from your insurance plan.

The best thing that can allow you to get complete advantage of your insurance plan is proper knowledge of all the insurance features and factors so that you can understand the actual nature of the insurance policy that you have taken for Uber cab.

In order to understand the insurance for Uber efficiently, you will need to do some research and if you don’t want to spend your days in research then you can read simple tips that can help you to get complete advantages of insurance. To save your time, here I am sharing with you some of the most common but highly effective tips that will certainly help you to get proper awareness and complete advantage of insurance without actually spending too much time in research for this matter.

Transportation Network Company (TNC) Terms: The coverage of insurance liability is necessary for every Uber drive and it will give the driver proper advantage of incidental or accidental death and personal injury. The Uber coverage also includes the passenger coverage but this is just timely because it is applicable on passengers from the time when they aboard the can and till the time they leave the vehicle.

Proof Of Insurance Coverage: If you want to make sure that you get the coverage advantage of Ridesharing Car Insurance then it is necessary that you carry the insurance coverage proof with you all the time so that the insurance company can provide you coverage instantly in any situation of requirement.

Understanding Of Rules: The rules of Uber Insurance are different for business and personal purposes. If you are running a business then the corporate insurance should be selected and if you are using Uber for personal purposes then you need to take the personal insurance for Uber. They will carry different quotes and the advantages will be different as per the basic insurance requirements.

There are so many people who ignore these simple things and then they face unnecessarily dissatisfactory consequences of issuance plan even when they have all the insurance features that they will need to satisfy their needs. Therefore, make sure that you don’t forget to follow the standard rules and regulations of Uber insurance. If you are confused about the terms then you can simply read the terms and conditions of insurance coverage of the insurance plan that you have taken for your vehicle.

This is the best thing to do to ensure that you are aware of all the necessary aspects regarding your vehicle insurance and this will definitely allow you to get best advantages of insurance whenever you need it. So, what are you waiting for? If you are ready to take the insurance or if you think that you are missing some advantages that you should be getting from the insurance plan that you have then you need to do proper reading of insurance features and conditions to get rightful features from your insurance plan.

More Articles

Copyright © Fooyoh.com All rights reserved.