Guide to building the ideal credit score

2021.10.27

The above equation shows that proper planning and a good credit score go hand in hand. But it's a bit tricky to build a good credit score because if the score isn't good, you can't get loans, credit cards, or even an apartment. However, all these things are vital and helpful in developing any business. You are living in the 21st century, where you can't go ahead without involving your credit. But at first, learn what a credit score is, and you can calculate it to form good strategies for business.

What is meant by credit score, and how to calculate it?

In simple words, a credit score is your ability to repay debts and all money-related liabilities. So, it is the easiest way to measure financial health and tell your lender so much about the situation. But if the score isn't good, you won't be able to secure good financial deals. Thus, if you have a good score, then it helps to open more doors for opportunities. If you want to improve your credit score, then you will have to make an effort.

Ranges of Good credit score:

If you wonder what the range of good credit scores is, you need to understand the FICO level. Usually, the credit score ranges between 300-850. But 300 is termed as a lousy score, whereas 850 is an excellent one. According to the FICO, here are some popular ranges of the two most popular scoring models.

FICO score ranges |

| Vantage score range |

|

300-579 | Very poor | 300-499 | Very poor |

580-669 | Fair | 500-600 | Poor |

670-739 | Good | 601-660 | Fair |

740-799 | Very good | 661-780 | Good |

800-850 | Excellent | 781-850 | Excellent |

So, if you want to grab good deals, then try to maintain the above levels. But there isn't any method to tell which way your lender will calculate the credit score. According to the search, on average, 67% of Americans have a good credit FICO score. Apart from this, 61% of Americans have a good credit score on the vantage meter.

How to build a good credit score: Top tips to share:

Most people struggle to improve their credit scores. But it's not an easy job, and you will have to adopt specific ways to achieve a good score. So, here are strategies to build a rock-solid credit score.

Pay off credit cards on time:

Credit cards play a crucial role in building a good credit score. So, prefer building your firm credit history. If you pay off debts on time, you will get so many benefits and rewards on financial matters. So, always pay off all credit card bills on time. When you carry forward the old balance, then interest grows over time and liability on your name. So, it destroys the name; that's why you shouldn't miss payments. But if you are unable to pay the bill of your credit score, then you have an option of becoming an authorized user on someone else's account. Apart from this, you can use the option of secured credit cards, and don't forget to discuss risks and downsides.

Get helpful information about credit bill payments:

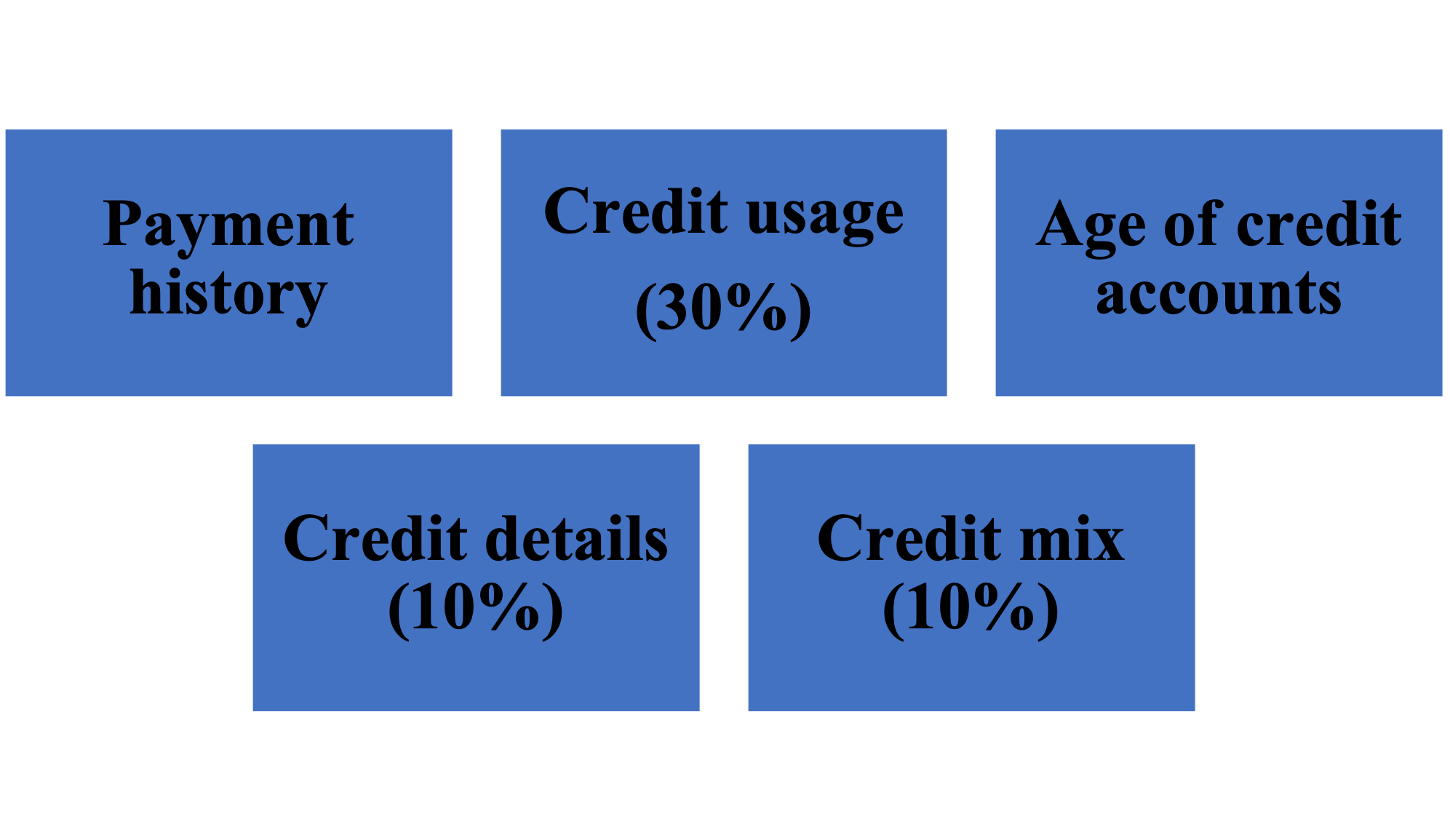

According to the FICO credit scores, certain factors come together to form a credit score. However, more than 90% of lenders use FICO ratios and criteria to determine the lending ability. Thus, by breaking down the factors, we get the following ratios:

So, the aggregation of all these factors has a more significant impact on credit history and score. It means that old loans, credit details, and age of credit accounts are responsible for making up your score. However, if you want to improve your credit score, try to develop a filing system using paper or digital methods.

Read your credit reports:

If you want to improve your credit score, then it’s vital to check your credit history. For instance, there are credit bureaus like:

● Equifax

● Experian

● Transunion

Apart from this, you can check the option of using "annualcreditreport.com" for free once a year. However, the review helps to repair bad credit scores. So, you can improve the score by restoring low balance, on-time payments, credit card loans, and credit accounts. Moreover, don't try to miss payments, credit card balances, and collections.

“Perfect strategies + good credit score = Impactful brand development.”

Try to utilize a set amount of credit:

In simple words, we name this term credit utilization. However, when we set a specific credit limit for usage, then it refers to credit utilization. For instance, set the budget limit that you are going to use up to 30%. According to the FICO credit score calculations, payment history is the second most vital thing to calculate the credit history. So, it means that the lender uses these criteria to check whether you are in sound financial condition or not. But if the credit utilization rate is more than 30%, don't forget to clear all debts at the end of each term.

Good idea to get a secured credit card:

A secured credit card is something that helps to design a good borrowing history. For instance, when you get a secured credit card, then it works as collateral. Later, the collateral amount act as a credit limit, and the company comes forward if you don't pay the entire debt amount. On the other hand, you can set alert alarms to know when the due dates of bills are coming up. Moreover, don't forget to use a paystub maker to keep track of income and expenses. You have the option of using automated bill payment methods to save time and hassle.

Other tips to improve credit score:

Earlier, we discussed that computer algorithms determine credit scores. So, if you want an improved score, then here are few other tips for adopting:

● Pay off all your loans on time

● Understand your credit report and try to act accordingly

● Settle your credit history

● Keep an eye on the recent activity of your accounts

● Use credit monitoring software to keep track of all activities

● Limit your new credit before settling the old one

● You can apply for a loan that helps to build credit

● Have an option of requesting to increase the credit limit

It's a good idea to improve your credit score to develop a business, get a new house, or apply for a loan. But it takes many weeks or even months to see an impactful difference in the score. So, it's good to start right away because, in this way, you aren't restricting growth and development. Moreover, you can seek professional help to mend your credit score to remove negative remarks from your history.

More Articles

Copyright © Fooyoh.com All rights reserved.